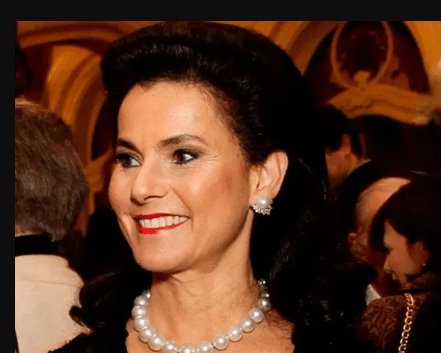

With an estimated net worth of $23.6 billion, Vicky Safra is the manager of one of the most significant private fortunes on the planet. After her spouse Joseph Safra passed away in 2020, she acquired this remarkably huge yet discreetly kept money. Her journey to financial success was paved with decades of family leadership, calculated choices, and a deeply ingrained banking empire rather than headlines or self-made startup drama.

By 1969, Vicky Sarfati had married into the Safra family, whose name was already quite well-known in European and Latin American private banking circles. The family’s entry into markets including Brazil, the US, and Switzerland was spearheaded by her husband, Joseph Safra. Vicky and their four adult children, who now each oversee significant portions of the business, smoothly took over the financial reins after Joseph’s death.

Vicky Safra – Personal and Professional Snapshot

| Attribute | Information |

|---|---|

| Full Name | Vicky Sarfati Safra |

| Date of Birth | July 1, 1952 |

| Age | 72 |

| Nationality | Greek-born, Brazilian citizenship |

| Residence | Crans-Montana, Switzerland |

| Marital Status | Widowed (married to Joseph Safra, 1969–2020) |

| Children | Jacob, Esther, Alberto, David |

| Net Worth | $23.6 Billion |

| Industry | Banking, Real Estate |

| Key Assets | J. Safra Sarasin, Banco Safra, Safra National Bank of New York |

| Philanthropy | Joseph Safra Philanthropic Foundation |

| Source |

Her eldest son, Jacob, is essential to the family’s international financial situation. His duties range from managing the Safra National Bank of New York to supervising the Swiss behemoth J. Safra Sarasin. The youngest, David, is in charge of Banco Safra in Brazil and manages regional real estate projects. The operational balance among various economic regions has been maintained with remarkable effectiveness because to this division of labor.

The family has deliberately increased its power over the last ten years, chiefly through its purchase strategies in the European financial markets. J. Safra Sarasin stated in March 2025 that it has reached an agreement to pay over $1.2 billion for a 70% share in Denmark’s Saxo Bank. This decision marked a renewed push toward fintech and digital banking services, and it was especially innovative in both time and implementation. The acquisition changed their access to cross-border wealth platforms and digitally native clientele in addition to expanding their footprint.

The Safras are extremely wealthy, but they have always maintained their modesty. Vicky Safra’s wealth is based on a variety of very effective private assets, in contrast to IT tycoons whose fortunes are dependent on fluctuating stock prices. These include equity investments in large economies, blue-chip real estate, and banking organizations. Their interests include commercial centers in São Paulo, valuable Swiss real estate, and skyscrapers in New York.

Vicky’s remarkably silent command is what distinguishes her from other billionaires, particularly female billionaires. Vicky hardly ever speaks in public, although celebrities like MacKenzie Scott and Françoise Bettencourt Meyers regularly make news. She manages one of the biggest family offices in international banking today, though, by taking deliberate steps and exercising extraordinary prudence.

Two of Vicky’s children, Alberto and Esther, sold their shares in the family business in 2024 and 2025, respectively. The transactions reveal modest family rearrangement, even though precise numbers were not revealed. Another significant family name is introduced into the larger storyline with Esther’s marriage to Carlos Dayan, the son of prominent financier Sasson Dayan. These connections highlight a trend that is especially prevalent in ultra-wealthy families: internal buyouts and marriages, rather than boardroom battles, are used to consolidate power.

Vicky’s legacy continues to be based largely on philanthropy. She directs significant funds for medical research, education, and the preservation of Jewish heritage as the director of the Joseph Safra Philanthropic Foundation. The foundation is a prime example of what many would refer to as understated effect because it purposefully and covertly uses family wealth. Instead of extravagant endowments, it funds long-term initiatives that subtly change organizations.

Living in the charming Swiss Alps town of Crans-Montana, Vicky leads a private and exclusive lifestyle. Financial elites have always favored Switzerland because it provides both personal liberty and regulatory stability. These qualities are especially helpful when managing intricate, global assets that need to be carefully negotiated under international financial regulations.

As the debate over income disparity has heated up in recent years, billionaires have come under more scrutiny. However, controversy has mostly avoided the Safra family. Their strategy, which is based on internal alignment, measured generosity, and quiet expansion, has proven especially resilient. They don’t put money into dangerous endeavors only to get publicity. They constantly choose carefully considered financial alternatives with long-term potential instead.

With each generation, the Safras have significantly expanded their global presence, in contrast to many banking families that have diminished over time. In the history of private banking, this is a unique accomplishment. Vicky’s position as matriarch is very crucial. She makes sure that choices are made with continuity and family values in mind in addition to financial objectives.