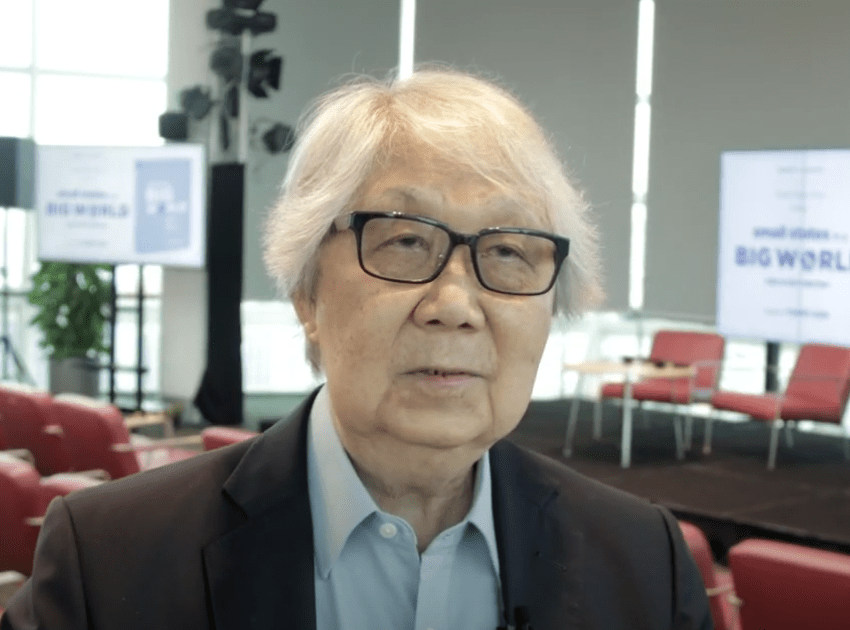

Due in significant part to Professor Tommy Koh’s contribution, which reframed the dispute as one of values, the dispute between Income Insurance and NTUC Enterprise has intensified into a national discussion. When a reputable ambassador and legal expert publicly calls on corporate executives to issue an apology to the government, the message transcends commercial mechanics and turns into a moral call for all Singaporeans to reevaluate the goals of their public-interest institutions.

The main source of contention is the S$2 billion in accumulated surplus that Income Insurance was permitted to keep during the 2022 corporatization process. With the stipulation that it be utilized to strengthen the insurer’s financial position, the Ministry of Culture, Community, and Youth (MCCY) had consented to exempt this surplus from being moved into the Co-op Societies Liquidation Account. Despite not being codified in law, the agreement was remarkably explicit in its purpose.

Tommy Koh and NTUC Income Controversy Overview

| Category | Details |

|---|---|

| Name | Professor Tommy Koh |

| Title | Special Adviser, Institute of Policy Studies (NUS) |

| Organisation in Focus | Income Insurance Ltd (formerly NTUC Income) |

| Related Entity | NTUC Enterprise |

| Key Issue | Dispute over S$2B surplus and capital reduction plan |

| Triggering Event | Allianz’s proposed acquisition of 51% stake in Income Insurance |

| Deal Value Proposed | S$2.2 billion |

| Capital Reduction Plan | S$1.85 billion returned to shareholders |

| Prof Koh’s Recommendation | Apology to Government, shift to organic growth |

| Authentic Source |

The following plan to sell Allianz 51% of Income Insurance for S$2.2 billion and a proposed S$1.85 billion capital cut, however, essentially went against the terms of that agreement. In addition to being significant, the cash extraction involved looked remarkably comparable to a pre-sale strip of value in terms of timing and intent. Professor Koh responded by calling the action a breach of trust that required both public repentance and strategic reassessment.

After a while, Allianz retracted their offer, claiming financial restraint. However, Professor Koh provided a very clear counterargument in his opinion piece dated December 23: Allianz retreated not because of hesitation but rather as a result of strong public emotion and the government of Singapore’s adamant resistance. Income’s statements during corporatization did not match the subsequent rapid capital reduction, as MCCY Minister Edwin Tong had previously said in Parliament. Particularly significant concerns were generated by the acquisition over Income Insurance’s ability to continue its social goal after the sale.

Professor Koh shifted the emphasis from financial metrics to civic responsibility by using his public platform. This was about whether a social enterprise could maintain its identity while negotiating the demands of corporatization, not about quarterly performance or risk-adjusted return. He cautioned that the planned agreement was a complete purchase rather than a merger of equals. Allianz would have acquired majority control, giving foreigners the power to shape strategic direction and, consequently, social mission.

In support of the plan, NTUC Enterprise claimed that Allianz would improve financial resilience, especially in times of economic downturn. They emphasized long-term viability and adequate money in their statement. However, Professor Koh and many other observers felt that the explanation was not genuine. The proposal had immediate and significant financial benefits: NTUC Enterprise would have received S$2.2 billion from the sale of its shares and S$403 million from the capital reduction. The narrative being given about inclusiveness and resilience is radically different from these figures.

These optics were important when it came to public trust. Similar worries were expressed by members of Parliament, who questioned how Income could guarantee capital strength one moment while returning almost all of its excess to shareholders the next. Notably, the contradictions were not adequately addressed in the ministers’ comments. Given that Income’s mission has long been presented as one of economic security and community development, the silence was especially loud.

NTUC Income was founded in 1970 with the goal of giving low-income workers access to reasonably priced insurance. This was a particularly novel idea at the time, given that this group lacked access to financial products. With guarantees that Income Insurance would continue to be mission-driven, that social backbone persisted even after corporatization. Income was “committed to driving financial inclusion through comprehensive and accessible innovation,” according to then-CEO Andrew Yeo’s January 2022 statement. This promise has been seriously weakened when viewed through the prism of the Allianz scandal.

Professor Koh made a sensible and morally sound suggestion: instead of searching for a buyer, begin building from inside. He urged NTUC Enterprise and Income Insurance to return to organic growth by making investments in people, technology, and innovative services without sacrificing their independence. This counsel has historical significance. Many of Singapore’s strongest institutions developed over time through purposeful, long-term growth in line with public service rather than through hasty mergers or ostentatious exits.

Additionally, he raised a grave worry regarding conflicts of interest. The chairman of Morgan Stanley, the transaction’s financial advisor, is also the chairman of Income Insurance. Professor Koh maintained that even when the person abstained from making decisions, the optics were still problematic. He claims that the appointment “gives rise to an appearance of conflict,” a morally dubious situation that might subtly damage an institution’s reputation.

Professor Koh has done more than just point out a corporate error in this episode. He has rekindled a national conversation about stewardship—the need to hold public institutions to higher levels of accountability and transparency. His views have been echoed by many in civil society in recent days, indicating a deeper concern about Singapore’s social sector’s continued transition into vehicles that too frequently prioritize commercial expansion over civic purpose.

This problem reflects global patterns as well. The conflict between private capital and social enterprise is becoming more intense across markets. Organizations that started out as charities or cooperatives are rapidly being dragged into for-profit operations, whether in the fields of health, education, or housing. However, Singapore’s governance model presents a special chance to take stock and change course. The public backlash that followed the Allianz deal’s blockage could represent a turning moment.