As one of Wall Street’s most brilliant financial thinkers, Howard Rubin previously commanded a fortune that stands in stark contrast to his estimated $5 million net worth in 2025. The career of Rubin, who is well-known for his keen intuition and groundbreaking work in mortgage-backed securities, embodies the genius and turbulence that have long characterized the financial sector.

After graduating from Harvard University with an MBA, Rubin became a successful trader at Salomon Brothers quite fast. His strategic contribution to the creation of collateralized mortgage obligations, a financial instrument that changed the housing market and subsequently impacted international investment patterns, contributed to his early career’s extraordinary success. Liar’s Poker, a book that captures the ferocity and aspirations of the bond trading age of the 1980s, even had a profile of him by Michael Lewis.

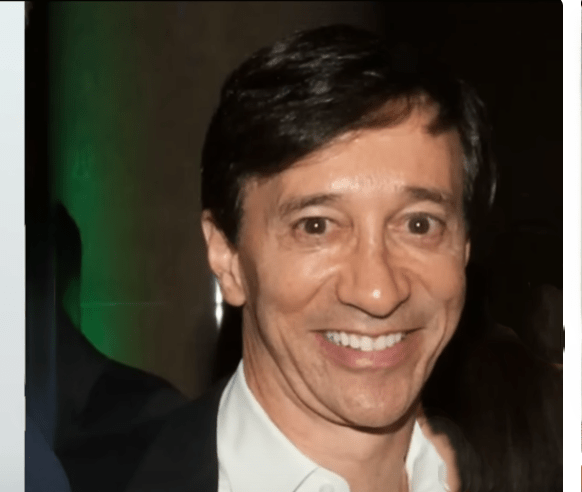

Howard Rubin – Personal and Professional Overview

| Category | Details |

|---|---|

| Full Name | Howard Rubin |

| Also Known As | Howie Rubin |

| Date of Birth | April 8, 1955 |

| Age | 70 years |

| Birthplace | Massachusetts, United States |

| Nationality | American |

| Education | Lafayette College (BS), Harvard University (MBA) |

| Occupation | Former Investment Banker |

| Net Worth (2025) | Estimated at $5 Million |

| Known For | Development of the Collateralized Mortgage Obligation (CMO) |

| Major Employers | Salomon Brothers, Merrill Lynch, Bear Stearns, Soros Fund Management |

| Marital Status | Divorced (Mary Henry, 1985–2021) |

| Children | 3 |

| Key Assets | Shares in Capstead Mortgage Corp and Global Ship Lease Inc |

| Reference |

Once associated with innovation, Rubin’s name has come to represent the financial elite. Prior to joining Soros Fund Management, where he oversaw billions of dollars’ worth of assets, he held prominent roles at Merrill Lynch and Bear Stearns during the height of his career. His bonuses were legendary, and his trades were smart and audacious. Because of how profitable his profession was at the time, his net worth easily reached the hundreds of millions.

Capstead Mortgage Corp (CMO) and Global Ship Lease Inc (GSL), two significant stock holdings that Rubin still owns today, are worth a combined $5 million. His highly concentrated portfolio, which includes 467,572 shares in Capstead and 62,500 shares in Global Ship Lease, reflects the risk-taking tactics he used in his previous profession. It is a small relic of a financial conglomerate that was formerly based on aggressive trading and accurate forecasts.

However, the personal and legal turmoil that now characterizes Rubin’s later life—rather than his financial savvy—is what really complicates his story. The 70-year-old banker was charged with federal offenses in September 2025, including bank fraud, interstate prostitution, and sex trafficking. Dozens of women who were allegedly recruited via social media and modeling platforms were the victims of a ten-year practice of coercion, according to the indictment.

Federal prosecutors claim that these encounters started in upscale hotels before shifting to a penthouse close to Central Park, which was purportedly transformed into a private space for BDSM meetings. According to the prosecution, Rubin abused victims physically and disregarded their permission by using his wealth and power to control them. Jennifer Powers, his former assistant, was also included in the indictment. She is charged with organizing contracts, money, and trips in order to quiet victims.

Rubin faces a minimum sentence of 15 years in jail and a maximum term of life in prison if found guilty. The accusations have severely damaged his financial status in addition to ruining his professional reputation. Once hailed as a pioneer of Wall Street innovation, Rubin is currently under intense scrutiny from a legal system that wants to hold the wealthy to account.

For a man who was once a regular at high-society galas and charitable gatherings, this case represents a startling reversal. He frequently donated to organizations like Hope for a Cure and the New York Junior League with his ex-wife, Mary Henry. In the past, their collaborative charity represented achievement combined with accountability. However, the 36-year marriage that had once seemed remarkably steady ended in 2021 due to personal and legal issues.

Beyond the news, Rubin’s story offers a deep reflection on responsibility and excess. He belonged to a generation that transformed American finance in the 1980s, transforming money into status and risk into art. However, decades later, it seems that he was followed into more sinister area by the same culture of hedonism and pushing boundaries. It’s a story that tragically reflects the widespread human predisposition to think that success makes one untouchable.

Rubin’s wealth is still largely protected by long-term investments despite his legal disputes, demonstrating how financial stability may endure even in the face of public shame. Given his continuous legal expenses, analysts have observed that his current wealth is astonishingly intact. This could be attributed to his conservative asset management, or possibly to the substantial reserves accumulated over a career of trading expertise.

Nevertheless, the transition from Wall Street behemoth to federal defendant highlights how brittle unbridled power is. Rubin’s path is especially similar to that of people like Jeffrey Epstein, whose enormous riches and power shielded them from punishment until justice was served. The cautionary tale of Bernie Madoff, another banker whose genius was overshadowed by moral decay, is also echoed in his biography.

Economically speaking, Rubin’s demise is a strikingly symbolic reckoning for a time when profit was valued more highly than morality. It calls into question high finance’s moral compass and whether regulatory bodies have gone far enough in stopping excesses associated with privilege and riches. Discussions concerning openness, consent, and the covert abuses that frequently accompany power have been rekindled by his case.

The financial community has been rocked by the indictment. While legal experts anticipate a protracted trial that may uncover more about the intricate relationships between money, influence, and misbehavior, many former colleagues have distanced themselves. The story has changed from one of financial success to one of personal misery for a man who was once described as a market genius.

However, Rubin’s experience needs to be viewed through a wider social lens. Rubin’s indictment seems extremely relevant in the context of the #MeToo movement, which changed the way that people talk about power abuse. It’s not just about one man’s deeds; it’s about a shared understanding that accountability must always come before influence.