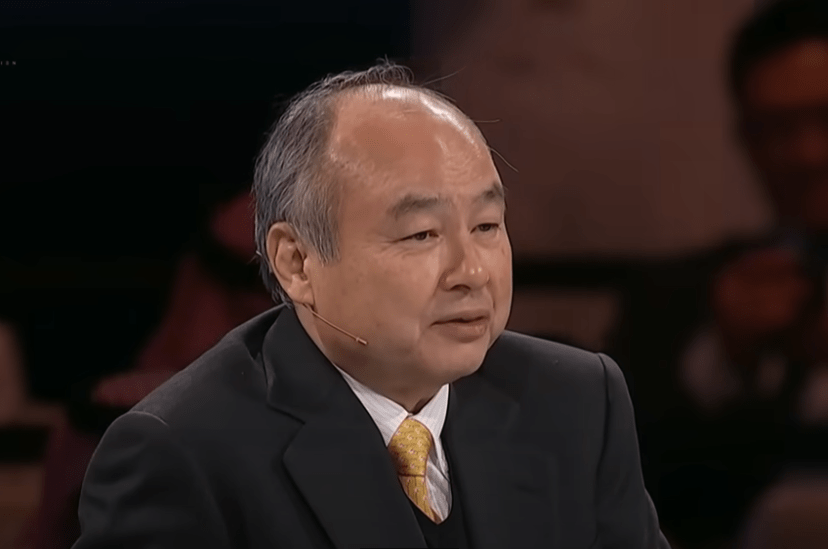

Once more, people are interested in Masayoshi Son’s net worth. He added an incredible $11 billion in just two weeks in August 2025, increasing his fortune to $62.1 billion and regaining his place as the second richest person in Japan. This comeback is especially noteworthy because it shows Son’s ability to adjust his approach at crucial times in addition to SoftBank’s financial recovery.

Son is the epitome of tenacity at 68. His narrative is not just about making money; it’s also about embracing change and turning it into motivation for new ideas. He lost an incredible $70 billion during the dot-com bubble, which is still one of the biggest personal financial losses in history. Amazingly, though, he used those setbacks as stepping stones to create an empire that depends on audacious technological wagers. His ascent bears a striking resemblance to Elon Musk’s financial turbulence episodes, in which equally spectacular gains frequently preceded equally spectacular losses.

Masayoshi Son – Biography and Financial Profile

| Category | Details |

|---|---|

| Full Name | Masayoshi Yasumoto (later Masayoshi Son) |

| Date of Birth | August 11, 1957 (Age 68) |

| Place of Birth | Tosu, Saga, Japan |

| Nationality | Japanese (Zainichi Korean heritage) |

| Education | University of California, Berkeley (BA in Economics & Computer Science) |

| Occupation | Entrepreneur, Investor, Philanthropist |

| Key Roles | Founder & CEO of SoftBank Group, Chairman of Arm Holdings, Chairman of Stargate LLC |

| Net Worth (2025) | $62.1 billion (Bloomberg Billionaires Index) |

| Known For | Vision Fund, Alibaba investment, AI-focused strategies |

| Spouse | Masami Ohno (m. 1979) |

| Children | 2 |

| Recognition | Forbes Most Powerful People (2013), Time 100 AI (2024), Asian Awards Entrepreneur of the Year (2017) |

| Source |

Son’s natural timing sets him apart from many of his peers. He turned $20 million into a stake in Alibaba that was once valued at over $100 billion by investing in the company when it was still just an ambitious idea. He had financial firepower that most investors couldn’t match because of that one choice. Even after his portfolio lost billions due to Beijing’s crackdown on tech companies, Son kept discovering new avenues, especially through SoftBank’s Vision Fund, which turned into a contentious but incredibly successful global tech investment engine.

SoftBank’s reputation has significantly improved in recent months thanks to AI. Despite warnings of an AI bubble from critics, Son stepped up his attacks on firms like Nvidia and TSMC. These investments have been especially profitable as AI spending moves from theory to adoption and infrastructure. SoftBank’s stock value has increased dramatically as a result of its strategic investments, which have made it a stand-in for the AI revolution.

His endeavors go well beyond chips. The purchase of Foxconn’s Ohio electric vehicle plant by SoftBank has raised anticipation for the company’s Stargate data center project, a massive $500 billion scheme involving OpenAI and Oracle. This initiative is especially creative since it seeks to establish Japan as the hub for the growth of AI infrastructure, which aligns with Son’s long-held conviction that technology can change society.

SoftBank’s digital payment division, PayPay Corp., is getting ready for a U.S. initial public offering (IPO), which could bring in billions of dollars. These moves demonstrate Son’s extraordinarily adaptable strategy, which combines infrastructure, payments, and AI into a single, coherent plan. His current fortune is a reflection of both his wealth and the sectors he supports, such as semiconductors and fintech.

The volatility is still there, of course. His willingness to take risks that most investors are afraid to take is reflected in his net worth, which has fluctuated like the tide. After Vision Fund losses in 2022, he made a vow to retreat, but here he is again, boldly betting on AI. His capacity for change makes him reminiscent of Steve Jobs, whose fortitude in the face of setbacks propelled his subsequent successes. Son’s story makes it very evident that volatility is something to learn to master rather than something to be afraid of.

His wealth’s effects on society are equally intriguing. Son’s bold investments upend the status quo in Japan, where corporate conservatism frequently rules the landscape. By demonstrating that measured risk-taking can transform industries, he has emerged as a role model for aspiring young businesspeople. His 2024 inclusion on the Time 100 AI list demonstrates how profoundly his influence has spread beyond finance to the innovation culture.

But he’s under constant scrutiny. Shareholders are uneasy due to concerns about governance, particularly his personal investments in SoftBank. His ambition occasionally surpasses his practicality, according to some critics. Even critics acknowledge, however, that his vision has accelerated technologies that might not have developed without his help. Son’s wealth thus symbolizes both success and conflict, a dichotomy that characterizes many transformative leaders.

His individuality is revealed through comparisons with other billionaires. Son’s trajectory is erratic and more in line with tech tycoons like Musk or Bezos than Tadashi Yanai, who founded Uniqlo on consistently consistent growth. He transforms industries rather than just amassing wealth. His wealth serves as a stand-in for the aspirations of the tech industry as a whole and a predictor of potential future opportunities.